|

The beginning of the XXI century is Famous for two fundamental discoveries in two interconnected spheres, namely, the spheres of

finances and music.

1.Capital

Nowadays, there are some theories which serve a kind of buffer between technical and fundamental market analysis. For example, the

theory of reflectivity developed by Soros. Actually, this is a description of strong tendencies of the market by means of non-technical

methods. According to Soros, in real life, market equilibrium can be scarcely observed. The theory of reflectivity explores the problem of

imperfect knowledge and of imperfect understanding a market situation. The thing is that imperfect understanding the market by traders is

specified by the fact that their frame of mind influences the situation which the frame pertains to. The real dynamics of the market has

already included the consequences of these moods.

What is a frame of mind? In fact, it is attention. It is the picture of attention , the frame of mind of participants of the so

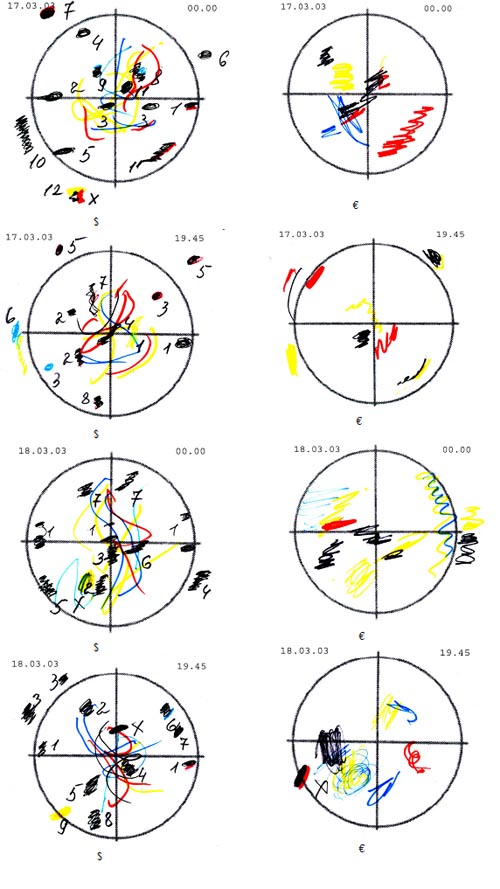

called market that is the object of our research. This is the market of the capital of the planet. We have developed a technology of

obtaining direct information about circulation of capital on the global scale. This information is monitored two times a day in the shape

of figures, which can be seen bellow. Many years of research of figures of this kind enables us to state definitely that they monitor the

real global attention to the US dollar.

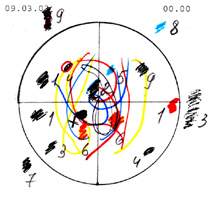

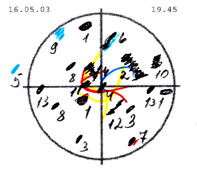

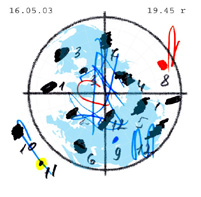

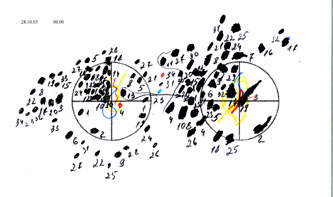

These figures are circles representing the sphere of the global attention to the US dollar. The circles are divided into four parts,

which represents the following event: in January 2000, the dollar divided into four parts (which will inevitably destroy the dollar system

in the end). Inside and outside the circles, there are some elements such as spots and curves of diverse colours. The meaning of the spots

will be explained below; now, we can say the following. The spots are the objects of attention, the way of their changing depending on the

kind of attention: there exists passive attention, related to a programmed behaviour of the dollar (this is a strategy), and there exists

active attention (this is tactics). It is the passive attention to the financial circulations in the world that is depicted by these plots.

As far as some colours go, the red and the blue on the figures represent some properties of attention. The red represents tension,

i.e., pressure upon the currency; the currency is pressed by means of diverse levers . The blue is opposite to the pressure and tention;

it is relaxation, i.e., the currency is released and it begins to behave according to objective laws of the market and approaches its

equilibrium price.

Thus, these figures indicate the real picture of what the US dollar is, and not of what we think of it and not the picture of what we

are imposed. Owing to such a daily integral picture of the distribution and timing it is possible to influence greatly all the segments of

the financial market.

Why is the attention attracted to the US dollar so greatly?

Generally speaking, attention is a phenomenon of nature. For instance, someone s attention is focused upon something permanently and

for a long time, and this something suddenly becomes meaningful and begins to influence. In other words, at some stage this focusing can

become the attention as such. Similarly, if a magnet touches a piece of iron for a long time this piece will acquire the properties of the

magnet. The situation pertaining to money is similar: if attention is permanently applied to money then the money can assume the properties

of this attention. This is a kind of phenomenon. This is what we call subjectivisation .

It was only the US dollar that was subjectivised up to the recent times. This shows as a powerful attention of the whole planet to

this monetary unit: even savages selling chaplet made of shells on an ocean shore know what the dollar is.

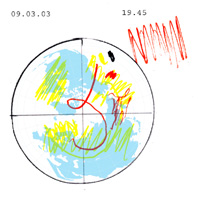

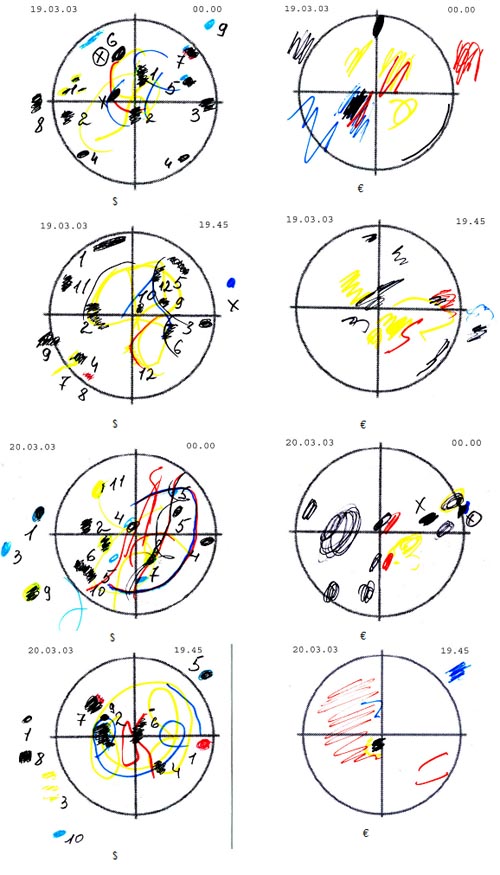

On March 9, 2003 the subjectivisation of the euro began. This was something new. This basic monetary unit began to attract attention,

not in the sense of concentration, but in the sense of the scale of this phenomenon, this being a trait of the beginning of stability of

this currency.

The figures (see below) illustrate this event. In the other words, on this day a great important change in the status of the basic world

monetary units, the US dollar and the euro , occurred: the dollar ceased to be the only world reserve currency and it is since this day

that the euro has been permanently sharing this function with the dollar 50:50; in fact, they go halves . So, the date March 9, 2003 is

an epoch making one in the financial history. It is on this date that the disintegration of the world dollar system began; this system

had seemed immutable and eternal. Certainly, we are going to be the witnesses of the fact that the euro will slump, but from now on the

dollar will never be able to bring the euro down, let alone oust it.

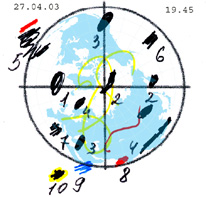

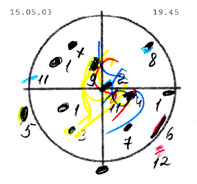

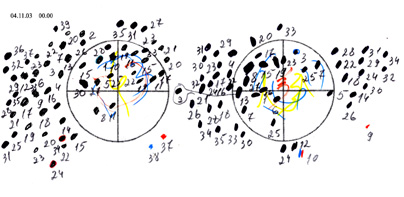

On April 27, 2003 the second meaningful event took place in the financial world. The figure referring to the dollar (see below)

illustrates this event.

In this figure, we can see a host of spots scattered all over the figure. A few spots are located outside the circle. All the spots

are numbered. Generally speaking, the spots are the places where circulation of capital is taking place as a result of making diverse

decisions on this capital. In other words, these are absolutely concrete events, e.g., summits, phone negotiations, etc., which cause this

circulation. The ordinary numbers of the spots are the numbers of these events within the sequence of their emergence, or the numbers of

these decisions. In the situation considered we can see from two to four numbers which are the same, namely, two equal numbers (pairs)

2,3,5,7; three equal numbers (triplets) 4,6,9; four equal numbers 1,8. All these can testify only to simultaneity of the events going

on. Namely, let us consider event 1; there are four spots with this number in the picture, one of them is outside the circle. According

to our observations the spots outside the circle always pertain to some extraordinary events in the world, for example, wars, acts of

terrorism, recurrent economic crises of diverse scales, falls of currency, drops in prices, etc. The emergence of spots always precede the

emergence of the events. In other words, by the emergence of such a spot outside the circle, it is possible to forecast the emergence of

some extraordinary event in the world. As far as the considered event 1 goes, we can assert that there were negotiations conducted between

four places on the Earth and these negotiations referred to the war in Iraq. More exactly, these were the negotiations on the capital

transfer in relation to the war in Iraq. The same can be stated about events 4,7,8 these negotiations were related to the war in Iraq

as well, but the number of the participants was different: three, two and again four accordingly.

What kind of inference can be made upon the basis of this figure? Being guided by our explorations of similar figures and considering

this figure we can assert firmly that on April 27, 2003 at 19.45 (Moscow time) the process of intensive disintegration of the world dollar

system was initiated.

It is between the mentioned so called pairs, triplets, etc., that the process of dividing the system into smart shares began; this process

began and is going on very intensely.

Besides, by our figures we observe the process of transferring the world capital from the dollar to the euro - at the initial stage

this process was random, i.e., we kept vigilant watch on the emergence of the transactions of this kind, these transactions emerged in a

random, chaotic way.

But in a while, some global programme started and the process of transferring the world capital from the dollar to the euro (i.e.,

from the old reserve currency to the new one) became more regulated. At some stage, there emerged a financial situation in which it was

correct to speak of the emergence of some integral reserve currency euro-dollar . Though, the process of transferring the world capital

was going on. Nowadays, we are monitoring feverish activities in the sphere of conducting transactions in the euro, which has never been

observed referring to the dollar.

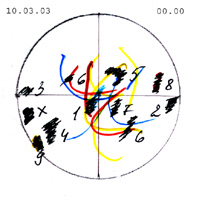

Below, we adduce several figures which represent the world financial situation on the eve of the war in Iraq and at the instance of

the beginning of the military operations (fig. of 20.03.03, 00.00). The war is known to have begun early in the morning on March 20.

By the way, in connection with the war in Iraq we issued a piece of leading information which was send out on May, 13 and 14, 2003,

to twenty-nine embassies of foreign countries (see the list below) in Moscow (see the text given in full):

Iraq War

The Americans involves into intellectual war at Iraq. June is the month, when the situation will be developing not in the favour of

the Americans. It will get out of control. As a result they will get not what they have been expecting. July is the month when everybody

will start understanding this.

Saddam Hussein is alive on this moment. We assert this with 100% certainly

American military machines may be nationalized, that is they will try not to let it out of Iraq and the neighbouring countries with

Iraq may participate in that. Someone will like to verify the capacity of the machinery.

The problem for the American army will be to with draw from Iraq, not to break into but exactly to with draw.

The Americans will have aggravations with talibs in Afghanistan. In July everybody will start to understand this. In general quit a

lot of unexpected things are being prepared in this respect which we cannot even suspect.

Thus, we see that the American system is moving towards being destructed because it is impossible to stop, it can be only destructed.

Embassies of the foreign countries in Moscow:

Bahrain, China, Great Britain, Egypt, France, The German Federal Republic, India, Indonesia, Iraq, Iran, Japan, Katar, Republic of Korea,

The Korean People s Democratic Republic, Kuwait, Luxemburg, Malaysia, Malta, Sultanat of Oman, Philippines, Saudi Arabi, Singapore, Syrian

Arab Republic, Switzerland, Thailand, United Arab Emirates, Vatican, Venezuela, Mission of Arabian States League, The Council of Trade

Development of Hong Kong.

Apart from this piece of information (see above), on the eve of the war in Iraq we issued the following piece of information:

In spite of the war, the US dollar will go down and down, thought this downward tendency will slow down now and then.

As for the information which our figures give, we can state the following. Since summer 2003, the most intensive capital split has

been going on in the USA. Usually, as a rule, concentration is more peculiar to capital. Here, quite the opposite is taking place: as a

matter of fact , capital is withdrawn wherever it can be withdrawn and is split into small parts, then it is transferred out of the USA.

This is a very dangerous tendency, in our opinion, and it is dangerous for the country itself.

Religion has dropped out of the dollar zone. This must be one of the most dangerous tendencies. The dollar used to influence religion,

but now this phenomenon has ceased. By the way, it would be very curious to watch how Vatican is involved in all this, and it is difficult

to imagine how seriously it is involved. If you are aware of this you can understand a good deal.

What is the difference between finances and capital? Finances wait on capital.

What is inflation? It is a situation when a part aspires to be the whole. Any solution to the problem of the dollar is artificial. As

а matter of fact, the only thing exists the interest. It is the only objective truth. And the United States will inevitably lose the

ground. In the end, everybody needs stability. The US do not bring stability due to a number of reasons.

Nevertheless, we would like to warn: the dollar system ought not to be destroyed and the US dollar ought to be supported with might

and main. Bringing the dollar down is advantageous to no one. Prior to this, the attention needs must be driven off. Without driving the

attention off, too a dangerous situation can emerge. It is dangerous due to the fact that the monetary unit as such is undermined; this is

not the active, but the passive attention which is going to increase, whereas it is only the active attention that supports any monetary

unit. By the way, the dollar will go out (and is going out) of the attention zone and, consequently, will lose (and is losing) the

confidence of powerful capitalists.

The dollar, certainly, is going to be unable to keep the pace and, most likely, it will fail despite all the measures assumed,

because psychology of the dollar seems to have failed itself. How has this shown up? This has shown up as continual aggressive wars.

Capital likes quiet.

It is becoming dangerous to unleash war as a whole lot of items emerge, namely, the so called ideological ones.

Actually, The Empire of Good is constantly provoking aggression. What can this mean? It stands to reason, democracy is not

determinant, is it? А whole lot of countries where bound to the USA because the Soviet Union used to exist, this being a very serious power,

and everyone tried to be organized against it. It ceased to exist, though the ideology of the Empire of the Good is the same. But

against whom? Against anyone! This is a property of the dollar. Obviously, the dollar has been consolidated with the ceaseless expansion

and aggression against both the internal and external market. Being aggressive is a fundamental property of the dollar which is regardless

of everything and is not based upon any values that are common to all the mankind. It is bound just to expediency and profitability, all

the rest means nothing. Besides, there is one more very important property of the dollar its fictitious nature, i.e., the dollar need not

be stable, but it needs must seem stable by 100%.

Being a young monetary unit the euro, unlike the dollar, is neither aggressive nor fictitious. It is more integral. It bares

absolutely different psychology. This is expressed at least by the fact that a host of countries have arranged and opened their frontiers

for each other. In some sense, this attests to unity of Europe. In the end, the basis of the new currency is the century-old traditions of

the European states which have made the arrangements. It is here that attractiveness of the new world basic currency seems to be concealed.

The gist of the collision of the dollar and the euro is the collision of two psychologies: the old one represented by the dollar and the

new one, the euro being the bearer of the latter.

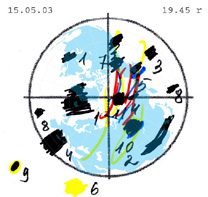

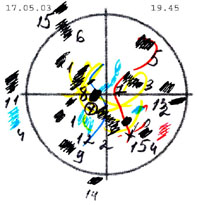

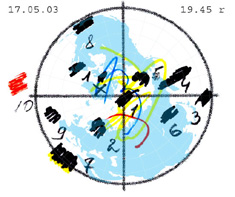

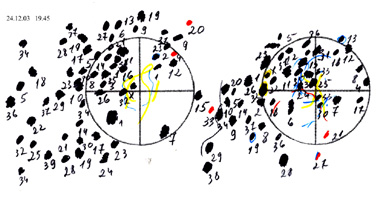

Very intensive financial activities in the world are monitored by our figures in the timespan from May 15 to May 18, 2003 (see

below). The spot with the index X is worth great attention.

Further. According to our figures, immense capital circulation from the dollar zone into the euro one is taking place in the world

nowadays. Moreover, we can observe a direct euro invasion of the dollar zone, even an invasion of the holy of holies of the dollar zone

(see bellow).

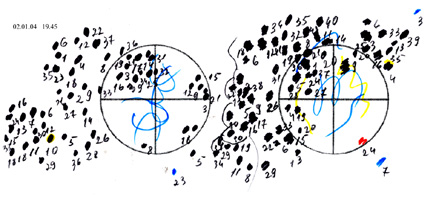

According to the figures (see below), capital has neither Cristmas holidays, nor the New Year Eve, nor any other vacations or

holidays.

By and large, the figures indicate clearly that there are immense change the world financial sphere. Nothing of the sort has occurred

so far.

Basing upon our figures we can elicit a good deal of information which is never published in the world mass media for the reasons

specified below; more then that, this kind of information has not been comprehended in full by those who take part in these processes of

the capital circulations and even by those who initiates the processes. Generally, the most covert and the most carefully guarded

information is not the state secrets, not military or scientific ones, but financial secrets; the latter are not liable to be made public

even after the expiration data of prescription. The most covert history is the history of finances.

Now, we would like to inform of some other potentialities of our financial informational technique which are more local. We offer the

following items of foreknown information which can be submitted in advance :

-leading information on upward and downward tendencies of the US dollar course for a month;

-the same, for a week;

-the same, for days;

-the same, for hours;

-the same, for oncoming events (diverse summits, G8, etc.);

-leading information on upward and downward tendencies of the most important business indicators, such as DOW JONES, NIKKEY, NASDAQ,

etc.

-the same, for the course of top-notch Russian and foreign companies shares for a week;

-the same, for an oncoming day, scheduled (from 00.00 to 14.00 and 14.00 to 00.00 Moscow time);

-the same, after remarkable events (e.g., summits, etc.)

Some examples of the leading information see below.

As a result of an exploration conducted at the Irkutsk stock exchange by users of our financial informational technique, the

analysts of the exchange inferred that in the timespan from 24.06.03 to 21.07.03 (20 days all together) our leading information on upward

and downward tendencies was trustworthy:

-for the shares of stock of РАО ЕЭС in 50% cases;

-too LUKOYL in 40% cases;

-too SIBNEFT in 35% cases;

-too SURGUTNEFTEGAZ 50% cases;

-too UKOS 30% cases;

-too ROSTELEKOM 45% cases.

Owing to the unique potentialities inherent in our financial informational technique we have found out that the day 07.11.03 was

unique in respect of concluding transactions for shares of stocks of several top-notch Russian companies. It was on this day that large-

scale transactions were concluded by a number of Russian companies, namely, РАО ЕЭС, LUKOYL, SURGUTNEFTEGAZ, UKOS, ROSTELEKOM. We had

observed nothing like this.

The biggest transaction which can be called extraordinary was concluded for РАО ЕЭС. Besides, we can remark that nothing special had

been going on around UKOS before this, just external diversions had been taking place. The transaction which took place on 07.11.03 drew

the line.

Further. We can offer leading information on upward and downward tendencies oil prices.

Providing information on other financial items (incipient and latent tendencies included) is also possible. The leading information

can be corrected in case of some unexpected events or vague situations; the latter can be predicted several hours in advance thus providing

a good chance to abstain from a transaction and minimize the financial risk.

The leading information on upward and downward tendencies of changes for all the mentioned indicators is offered daily from 00.00 o

clock Moscow time. The allowed leeway is enough the information is offered at least several hours in advance. The possibility to issue

the information is hourly, in an emergency the possibility to issue the information is continual.

Оn the whole, the principle of our work is the principle of a lacking link . By the way, Mr. Soros is a man of link as well and he

means next to nothing on his own. And we are aware of the secret of Ms. Soros: he is lying impudently when he states that he is having a

backache for money . As a matter of fact, he has a backache for people who can feel а currency system.

2.Music

Sorry, English version is preparing. "

|